Introduction

Fundraising is an important backbone for many businesses, especially those during their initial and growth phases. Fundraising is essentially where you raise money to fuel your business dreams, expand toward new horizons, and bring your creative ideas to life. So, what is fundraising in business, and what is its significant place? This extensive guide will provide details on the ins and outs of business fundraising—defining and discussing it, discussing its importance and methods, discussing challenges, and most importantly, underlining how you can better position your fundraising using resources like Do My PowerPoint for professional pitch deck design services. Whether you are an aspiring entrepreneur, a startup founder, or an owner of a small business looking to scale up, the art and science behind fundraising have great importance in the success of every businessman in the competitive business times of today.

Fundraising is not just about raising capital; it’s actually building the skeleton upon which business growth and sustainability will happen. With increased competition in the market, entrepreneurs and business owners have to be ready to meet various challenges from a financial standpoint while trying to turn their ideas into reality. Effective fundraising skills generate funds to finance product development, expansion, and thereby outpacing competition. Fundraising covers more than just the short-term financial needs; it is a very strong tool for defining the company’s direction, as through it, the company is able to reach innovation and strategic partnerships. Understanding the various facets of fundraising is essential for anyone looking to thrive in the business world.

What is Fundraising in Business?

Fundraising in business is a strategic process where one secures financial resources to take the company through different aspects of its operation, growth, and development. It involves identifying potential investors or funding sources, presenting your business idea or expansion, and the art of convincing them to invest their money in your venture. The ultimate goal of fundraising is to gain adequate capital to achieve certain objectives in business, whether it be the launch of new products, expansion into new markets, or merely survival during bad times.

Y Combinator’s YouTube channel has prepared this video on How Startup Fundraising Works | Startup School. Watch it below:

Business fundraising is not all about asking for money; it deals with relationships, the potential in your business, and finding your vision aligned with the interests of investors. Successful fundraising requires a deep understanding of your business model, market dynamics, and the value proposition you offer to both customers and potential investors.

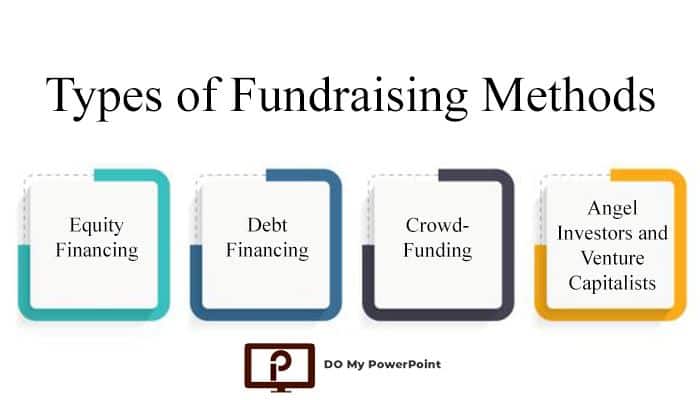

Fundraising in business can take many forms, from traditional bank loans to crowdfunding campaigns. The means you choose often depends on the stage of your business, the industry you represent, and other particular needs. Here’s a view of some common fundraising methods:

1. Equity Financing

2. Debt Financing

3. Crowdfunding

4. Angel Investors and Venture Capitalists

Each of these methods has its pros and cons, which we will later detail further in this article.

The importance of fundraising in business cannot be overstated. It fuels growth, innovation, and competitiveness. Without adequate funding, the most brilliant ideas might just remain a distant dream. Fundraising enables the business to:

• Develop and launch new products or services

• Expand into new markets or location

• Invest in research and development

• Hire top talent

• Upgrade technology and infrastructure

• Weather an economic slowdown or an unforeseen event

Moreover, the process of fundraising itself might serve as an added benefit to businesses. This process forces the hands of the entrepreneur to evaluate their business plan critically, mitigate strategies, and present their vision as clear as it should be. This sometimes gives way to improvements in the business model.

And for attracting investors, a compelling pitch deck is crucial. At Do My PowerPoint, we know how to create a great-looking pitch deck professionally and give the best showcase possible to your business. Our affordable prices, high quality, and fast delivery are going to make sure you always impress your investors. Explore the PowerPoint Presentation Price List of Our Exceptional PowerPoint Design Services Here!

Types of Fundraising Methods

Business fundraising comes in various forms, each with its different strengths, obstacles, and suitability depending on a company’s age, industry, and financial requirements. We discuss here the main methods of fundraising and provide examples and insights to help you determine the best approach for your business.

Equity Financing

Equity financing is a process for raising funds by selling shares of your company to investors. In return, investors gain certain ownership interest in your business, probably along with the voting right and claim on some percentage of the profits in the future. This is particularly appealing for growth-oriented firms and startups with low revenues at present or limited assets that can be pledged as collateral.

“Equity financing is not just about the money—it’s about the mentorship, networks, and strategic guidance that seasoned investors bring to the table.”

Advantages of Equity Financing:

• No Repayment Obligation: There is no requirement for set repayments with equity financing. This means less financial stress being placed on your business.

• Access to Expertise: Many investors, especially venture capitalists, come with a lot of industry experience along with guidance and contacts.

• Enhanced Credibility: Great investors bring credibility, and this could increase demand for future investment in your company.

Example: Mark Zuckerberg raised $500,000 in equity financing from the co-founder of PayPal, Peter Thiel, in 2004 to invest in Facebook, now called Meta. This investment helped build Facebook into the powerhouse tech company.

Debt Financing

Debt financing involves borrowing money that needs to be repaid over a period of time with interest. Through this avenue, businesses can maintain full ownership but use access to borrowed capital to finance their growth initiatives. Debt can be raised through a bank, credit union, or alternative lender.

Advantages of Debt Financing:

• Retained Ownership: Accessing capital through borrowing does not dilute your ownership in the company.

• Predictable Payments: Fixed repayment schedules ensure payments are predictable for better cash flow management.

• Tax Benefits: Interest payments on debt are generally tax-deductible and so lower the net cost of borrowing.

Example: Tesla Motors (now Tesla, Inc.) borrowed $465 million from the U.S. Department of Energy in 2010 to accelerate its electric cars. It was a significant loan for Tesla, which it repaid in full by 2013 well ahead of the scheduled nine-year time frame.

Crowdfunding

Crowdfunding is the act of raising small pieces of capital from a large number of individuals, typically via online platforms. This is great for companies that have a special product or a social mission that the public will be interested in.

Advantages of Crowdfunding:

• Market Validation: Public interest is seen as a way to validate your business idea before a full-scale launch.

• Marketing Exposure: Crowdfunding campaigns provide ways to build hype and even gain media interest.

• No Ownership Dilution: Like small business grants, reward-based crowdfunding, in particular, does not involve equity dilution.

Example: Pebble smartwatch raised over 10 million in Kickstarter funding back in 2012, against its initial goal of 100,000. This crowdfunding exercise helped Pebble gain a foothold in the smartwatch market.

Angel Investors and Venture Capitalists

Angel investors are rich individuals who, in return for equity or convertible debt, fund money to startup businesses. VCs (Venture Capitalists), on other hand, are professional investors that deal in managing pooled funds to invest in high-potential startups and early-stage companies. Both have crucial roles in filling up the gap in finance for enterprises bound for rapid growth.

Advantages of Angel Investors and VCs:

• Significant Funding Amounts: These investors often invest substantial capital to finance ambitious growth plans.

• Strategic Guidance: Beyond funding, angel investors and VCs can offer guidance or strategic mentorship, and at times, important industry connections.

• Prestige and Networking: Getting investment from reputed and renowned angel investors or VCs might open further doors to other funders and partners.

Example: In 1999, Google received $25 million from two firms that were venture capital firms named Sequoia Capital and Kleiner Perkins. It played an important role in the aggressive growth of Google and its hold over the search engines.

| Fundraising Method | Best For | Typical Funding Amount | Key Consideration |

| Equity Financing | High-growth startups | 100,000−10 million+ | Willingness to give up ownership |

| Debt Financing | Established businesses | 10,000−1 million+ | Ability to make regular payments |

| Crowdfunding | Consumer products, creative projects | 1,000−1 million | Strong marketing and community engagement |

| Angel Investors | Early-stage startups | 25,000−500,000 | Network and ability to pitch effectively |

| Venture Capital | High-potential tech startups | 500,000−50 million+ | Scalable business model with large market potential |

Fundraising isn’t just about using the right approach; it is equally about portraying your business in the best possible light. The team of experts at Do My PowerPoint truly understands the subtlety of each of these approaches to fundraising and can help you in crafting a pitch deck that that resonates with your target investors.

The Importance of Fundraising for Business Growth

Fundraising accelerates business development along a few critical dimensions, including:

1. Growth Acceleration

Fundraising provides capital for expansion in markets, scaling of operations, and product development, which finally brings impact on revenues and market share. Example: Airbnb tapped more than $6 billion in funding to evolve from a local platform to a leading global hospitality provider.

2. Innovation Investment

Funding enables investment in R&D and new technologies to keep up with emerging market needs. Example: Tesla has been continuously fundraising to enable its continuous improvement in electric vehicles and their energy storage technologies.

3. Market Position

The strategic deployment of funding helps reinforce the competitive advantage through talent acquisition, technology upgrade, and marketing reach. Example: Uber invested heavily in rapid expansion in the market and was able to quickly defeat traditional taxi services.

4. Financial Resilience

Strong funding means stability during economic turmoil and growth plateaus. Example: Amazon was well-funded right from the beginning and thus survived several years of operational losses while developing infrastructure for e-commerce.

5. Talent Acquisition

A well-funded company can promise a competitive salary with prospects for career advancement in order to attract the best talents. Example: Funding allowed Google to create the best working conditions to attract top tech talent.

6. Market Trust

The backing by leading investors reinforces one’s market standing and, consequently, impacts customer acquisition, relations with suppliers, and publicity in the mass media. Example: Stripe rode the wave of its high-profile investors to establish its place in payment processing.

Steps to Prepare for Fundraising

Setting up a successful fundraising campaign requires good planning and strategic execution. Here are the basic steps to prepare for fundraising:

Developing a Solid Business Plan

A comprehensive business plan is the foundation of any fundraising effort. It’s where you detail your business’s mission, market analysis, competitive landscape, operations strategy, and financial projections. A well-penned business plan has the ability to make your targeted investors believe that you really have a great idea, and a path forward where it can be successful.

Key Components:

• Executive Summary: A concise summary of your business and its goals.

• Market Analysis: An understanding of industry trends, target market, and competition.

• Product or Service Description: Detailed look at what you sell, and its unique value proposition.

• Marketing and Sales Strategy: How you’ll reach your target audience and drive sales.

• Financial Projections: projection of income statements, cash flow statements, and balance sheets.

• Team Overview: Information about the founding team and key personnel.

Identifying Potential Investors or Funding Sources

Understanding where to seek funding is critical. Different fundraising techniques apply to different investor types. Identifying the proper funding sources is in line with the stage, industry, and financial requirement of your business.

Potential Funding Sources:

• Venture Capital Firms: For high-growth startups needing serious capital.

• Angel Investors: For early-stage companies that need guidance as much as they need money.

• Banks and Credit Unions: For businesses with stable revenues looking to seek debt financing.

• Crowdfunding Platforms: Best for consumer-facing products with mass appeal.

• Government Grants and Subsidies: For businesses that engage in research, innovation, or public services.

Crafting a Compelling Pitch

A great pitch is what secures interests and further attracts funding. Your pitch should summarize your business idea, market opportunity, competitive advantage, and financial projections. Plus, this is where you make your ask, the amount of funding you need and what for.

For more information about pitch decks, visit our previous article where we have gone in depth on What Are Pitch Decks and How to Design a Pitch Deck that will impress investors.

Tips for an Effective Pitch:

• Start with a Hook: Grab attention with a compelling story or a startling statistic.

• Clearly Define the Problem: You will explain the problem your business solves and its importance.

• Present Your Solution: You describe your product or service and how well it solves the problem.

• Highlight Market Potential: Show the market size and who your target audience is.

• Demonstrate Traction: Show proof of progress, such as sales, user growth, and partnerships.

• Outline Financials: Show realistic financial projections and essential metrics.

• Conclude with a Strong Ask: Clearly state the funding that is required and what that means to your business’s future.

The cornerstone of any great pitch is a powerful pitch deck. Pitch decks Design Services from Do My PowerPoint ensure that your presentation is created to capture attention, communicate, and leave long-lasting impressions. Contact us today to get started!

Challenges in Fundraising and How to Overcome Them

Fundraising comes with its own set of significant challenges that can intimidate even the best-prepared entrepreneurs. Learning from them and using effective strategic solutions can overcome these barriers and prepare your business for successful fundraising.

1. Finding the Right Investors

Finding an investor with the right tunable mindset for your business goals and values may be a challenge. Not every investor may have the same vision or direct interest in the company, so targeting the right people or institutions, in the first place, will make a difference. Competition further exacerbates the challenge since an innumerable number of startups vie for the attention of only a limited pool of investors.

“The greatest challenge in fundraising is not finding capital but aligning with investors who share your vision and values.”

Use sound research to find investors who have the track record of investing in businesses from your industry or in the stage of development in which your business is. Networking events, industry conferences, and online platforms like AngelList are the best ways to get connected with prospective investors. Craft your pitch better toward their investment priorities by highlighting common values and goals.

2. Standing Out in a Crowded Market

With thousands of businesses competing for funding, differentiating yourself is critical. Investors are inundated with pitches daily, so failing to make a strong impression can lead to missed opportunities.

Create an attractive and well-structured pitch deck that shows off your unique selling proposition. Significant attention needs to be directed toward traction, which may be in the form of customer acquisition metrics, revenue growth, and key partnerships. This could also be a point in your storytelling ability, showing passion for how real and impactful your business will be in the world.

3. Valuation Disputes

Determining the right valuation for your business is often a contentious point in fundraising discussions. Overestimating your valuation may deter investors, while undervaluing your business could lead to unfavorable deals.

Base the valuation on solid financial data and industry benchmarks. Key drivers of value would include things like intellectual property, a existing customer base, and market potential. Be flexible; consider taking advice from financial advisors or mentors to arrive at a fair valuation that reflects reality.

4. Maintaining Control and Ownership

Accepting external funding often comes with the risk involved in the loss of control over the decision-making process in a company. Certain investors might ask for an equity stake or a seat on the board, which has a dilutive effect on control.

Negotiate conditions that preserve your control over the business while pleasing the investors. Make a clear setup of roles and responsibilities for all parties concerned, and raise money from investors who will respect your autonomy. If the ownership of your company is a core factor, then consider debt financing or revenue-based loans.

5. Unrealistic Expectations and Rejections

Rejections in fundraising are quite common, as sometimes investors may have unrealistic expectations about profitability, scalability, or market potential.

Practice your pitch; take the feedback and work to make it even better; and don’t be deterred. Anticipate any likely objections that might arise and seek to identify and deflect them in the pitch itself. A resilient attitude and growth mindset will help you navigate the ups and downs of the fundraising journey.

6. Time-Consuming Process

Fundraising is an exhaustive, time-consuming process that diverts necessary attention away from other critical aspects of the business. Many times, it is very challenging to balance the two sides of the fundraising and operations.

Plan fundraising well in advance, allowing realistic timeframes and milestones for this. Share operational responsibility with trusted team members or bring in interim support to help while keeping the business running smoothly.

By addressing these challenges head-on, entrepreneurs can take what would be roadblocks and make them catalysts for growth and learning. Fundraising is not an art of raising capital; it’s an exercise in building resilience, whetting strategies, and forging meaningfully deep relationships which may propel your business to new highs.

Conclusion

Fundraising forms one of the most integral parts of business growth and development. It brings in the capital needed to innovate ideas and expand operations, thereby building a competitive edge in the market. Whether it be equity financing, debt financing, crowdfunding, or looking for angel investors and venture capitalists, knowing the difference between each of these methods will help in making the right choice.

Remember, successful fundraising is more than just getting the capital; it is actually building a relationship, refining your business strategy, and positionally placing your company toward success. With an evolved business plan, identification of the right target investor base, an astounding presentation, and preparation for due diligence, the probability of success in your fundraising efforts will increase significantly.

As you embark on your fundraising journey, remember that preparation is key. A well-crafted pitch deck will make all the difference in your investor interest and in communicating your business vision.

Our group of expert designers at Do My PowerPoint works around the clock to make sure your pitch deck not only looks professional but also tells your unique business story with the most powerful effect. We offer our presentation design services at affordable prices, with super-fast turnaround times. That makes us the ultimate partner in your fundraising journey. Let us help you create a pitch deck that investors can’t ignore!